The priority and focus of the management of public companies is well defined: increase shareholder value. In fact, the board of directors in a public company has a fiduciary responsibility to do just that. However, the goals of private company owners vary and has a wide range of objectives. Yes, most care about inc reasing the value that can eventually be monetized and reducing their tax obligations; but many have parallel ambitions and motivations; social, personal and community considerations weight heavily into their decisions. For example, some businesses seek to create jobs and provide employment for their community in a region that may be economically depressed or under privileged. Some businesses are operated as a mission of Christ, seeking to evangelize and live-out the word of God and the work of the church. Others have legacy considerations and are managed as a means to provide family wealth and employment for generations to come… and the list goes on. The mix of motivations and ambitions begins to define the eventual transfer channel or succession path for future ownership, which in turn defines the parties that will likely be involved in the future of the company. The transfer channel and parties involved in that channel shape the approach in valuing the business. So to the point, owner ambitions and motives directly impact the value of a privately held business.

reasing the value that can eventually be monetized and reducing their tax obligations; but many have parallel ambitions and motivations; social, personal and community considerations weight heavily into their decisions. For example, some businesses seek to create jobs and provide employment for their community in a region that may be economically depressed or under privileged. Some businesses are operated as a mission of Christ, seeking to evangelize and live-out the word of God and the work of the church. Others have legacy considerations and are managed as a means to provide family wealth and employment for generations to come… and the list goes on. The mix of motivations and ambitions begins to define the eventual transfer channel or succession path for future ownership, which in turn defines the parties that will likely be involved in the future of the company. The transfer channel and parties involved in that channel shape the approach in valuing the business. So to the point, owner ambitions and motives directly impact the value of a privately held business.

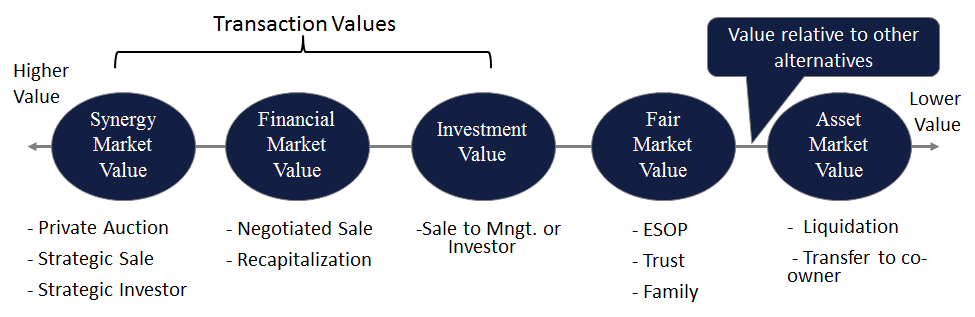

Our chart below is meant to provide a view of the concepts mentioned above –

Let’s discuss an example. The owner of a privately held company desires to transition the business to his daughter, part of the transition being gifted with the remainder being purchased with a combination of bank debt and a seller note. In our chart, that would fall under the bubble that indicates “Fair Market Value” which is governed by an IRS set of rules. The concept of FMV has been litigated and is reasonably well defined… and most of the time tends to be on the lower end of the valuation spectrum illustrated above. So the decision to transition the business to family will likely result in a lower valuation for the business compared to the sale to a strategic buyer. Thus the ambitions of the owner directly impact the realizable value. There is no judgment nor right or wrong; the point is to illustrate the difference between value that can be monetized and the inherent value to the owner that translates into social, family or community value.

Whether in Raleigh North Carolina, where we’re located, or in another part of the US… we’ve learned to begin the process of exit or transition planning with a discussion and understanding of what’s important to owners of the company, and how their business fits into their financial and personal ambitions.