Company Sale / Exit Alternatives

Shareholder Transitions, Liquidity & Divestitures

The Transition Accelerator® is our proven service as part of what we call Enterprise Value(EV) Engineering® . We develop and implement exit & liquidity alternatives. The section below titled “Approach” provides details on selling your company.

ow do you get the best deal for yourself and your shareholders ….AND at the same time take care of your committed employees, partners, customers and stakeholders? Maybe you have been approached to sell your company (or a part of it) and you want to optimize the value for you and your team?

At some time in the life of all private businesses, as owners, we must think about how our company fits into our investments. For many of us, this ownership represents our biggest investment financially, biggest investment in mindshare and greatest investment of time.

In today’s market, there are numerous alternatives to transition out of your business or create financial liquidity. Below we have assembled information and resources to help you think about succession planning, the sale of your company and other options. Our goal is to share some of our experiences and process in helping you achieve your objectives.

What We Do

In today’s economic environment, to successfully sell or recapitalize your business, owners of emerging growth and middle-market companies need more than bankers, brokers or consultants to get the value they want from their business. Being strategically and operationally prepared can make the difference between a successful company sale and not getting a deal done at all.

High Rock Partners has the unique mix of experience, talent, skills and tools to help you determine the real exit alternatives and do it the right way. Our team is led by a senior executive that can view your business from both sides of the table: as an operator (because we’ve been there growing and selling our own companies) and from the capital markets perspective. …then roll-up our sleeves to support your team in proactively preparing and executing on your plans.

Example Deal Types

- Sale to a strategic buyer (domestic or cross-border)

- Sale to a private equity group

- Generational transition / sale

- Management buyout

- Buyout a partner / minority shareholder

- Recapitalization

- Merger

- Divestiture

One difference between our firm and traditional brokers & bankers – our principals have been in your shoes …we have owned, operated and sold multiple businesses AND we have advised and led preparation and liquidity events for our clients. We can do this for you.

Our Approach

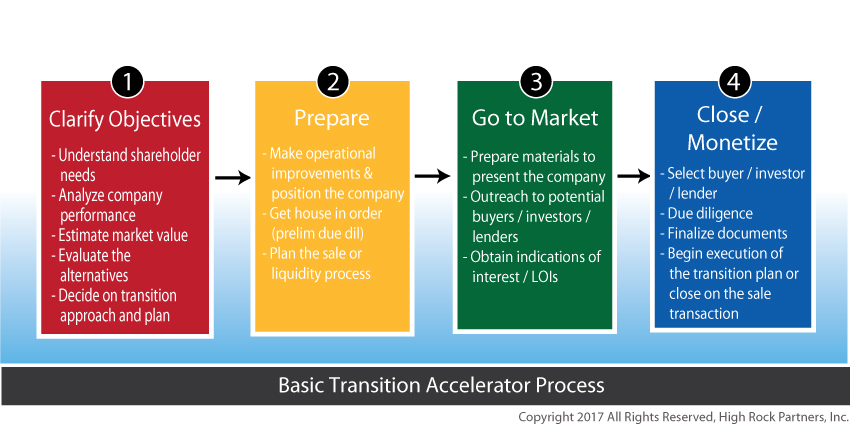

The graph below illustrates (at a very high level) the big steps in the process of selling all or part of a business. We couple this with our strategy tools to form the Transition Accelerator® framework. Using the base approach, we tailor the steps for each client assignment based on the specific goals and desired outcomes.

Embedded in the steps below are key steps to:

- Clarify objectives, and explore exit and liquidity alternatives

- Determine the likely range of values of the company in a transaction

- Provide recommended areas for improvement or preparation to increase value and the likelihood of close

- Provide a strategy to meet objectives